Given Australia’s publicly funded universal health care, is private health insurance worth it?

Last June, shortly after I lodged my application for a de facto partner visa subclass 820, I received a bridging visa. That made me eligible for Medicare, which I enrolled in immediately. For my American readers, Medicare is Australia’s publicly funded universal health care scheme.

Now that it’s been nearly a year, I received a letter from the Department of Health to inform me that I will soon be affected by Lifetime Health Cover, which involves a financial loading after the age of 30. I had to read this letter about three times and ask all my Aussie friends before I could figure it out, and it’s still confusing. I’ll try to explain for the benefit of anyone else who may go through this.

In Australia, we tend to talk about Medicare as being free, but it isn’t, of course; it’s taxpayer funded. Australians pay a Medicare levy of 2.0% of their taxable income. This is reduced if your taxable income is below a certain threshold.

In order to reduce the demand on the public system, the government encourages Australians to purchase “private health insurance”. Private health insurance refers to (1) hospital cover and (2) extras (e.g. dental, optometry, therapy, etc). It’s important to note that these are in addition to Medicare; they don’t replace Medicare. And you can, more or less, pick and choose, and build the kind of health coverage you want. For example, you can have Medicare and hospital cover, or Medicare and extras, or all three.

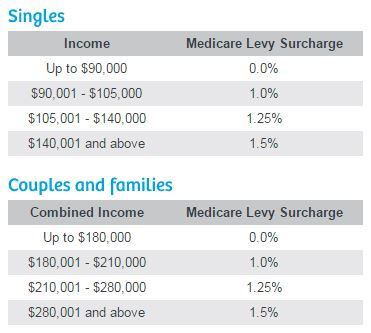

The government encourages Australians to purchase hospital cover. It does this by offering a rebate and also by imposing a Medicare Levy Surcharge (MLS) on Australians who don’t have the appropriate level of hospital cover and who earn above a certain income. Purchasing the extras doesn’t avoid the MLS, only hospital cover does.

If you are over 31, you have one year from the date you registered for Medicare benefits to purchase private hospital cover without incurring a loading. That’s why I received the letter. I’ve been on Medicare for a year. Now I have to make a decision: purchase private health insurance (that is, hospital cover) or incur the MLS.

How much is the MLS?

It depends.

For example, let’s say I’m a single person earning $95,000 a year, which means my MLS is 1%. This year, I would have to pay an extra $950 in tax (1.0% of your annual income). For about that or less, I could purchase hospital cover.

Medicare versus private health insurance

Medicare covers a lot, too much to list. In fact, the complete Medical Benefits Schedule is about 900 pages. But it doesn’t cover everything. That’s where private health insurance comes in.

When it comes to hospital costs, Medicare does not cover private patient hospital costs, services that are not clinically necessary, or ambulance services. You cannot choose your own doctor and you may not have a choice about when you are admitted to hospital.

For example, my partner’s stepmother needs a hip replacement. She’s in her 70s and has great trouble walking. She has no hospital cover and, since her condition is not life-threatening or deemed urgent, she’s on a waiting list. She’s been waiting for two years. If she had private health insurance, she would not have to wait as long.

In contrast, when it was discovered that I had a dangerously low level of iron in my blood or needed my gall bladder removed, I was admitted to the hospital immediately. When my partner’s daughter came back from her holiday across four Asian countries with a weird stomach bug, she was admitted to the hospital immediately. When his sister was diagnosed with cancer, she received immediate attention and had surgery (she is now cancer-free).

Extras cover other conditions and services that are less dire, but still important that Medicare doesn’t such as dental examinations and treatment, various kinds of therapy (e.g. physiotherapy, chiropractic services, podiatry, psychology services), glasses and contact lenses, and hearing aids.

To a large degree, you can pick and choose your extras. For example, you could choose basic dental for check-ups, cleanings, fillings, and extractions, but for root canals, crowns, and other major work, you’d need additional (and more expensive) coverage.

Lifetime Health Cover loading

Lifetime Health Cover (LHC) loading is another government initiative to encourage Australians not just to take out hospital cover, but to take out at a younger age. Basically, the way it works is by penalising you more the longer you wait.

For every year over the age of 30 that you don’t have private hospital cover, a 2% loading is applied to the cost of your insurance. It accumulates. For example, if I purchase hospital cover now at 37, my LHC loading is 14%. If I purchase it at 50, it will be 40%. And it keeps increasing each year until it reaches 70%. Once you’ve held continuous private hospital cover for 10 years, your loading is removed.

Details

To add the complexities of all this, there are numerous details to keep in mind such as excesses and waiting periods. Even with private health insurance, there may be waiting periods for certain procedures or if you have a pre-existing condition.

Is private health insurance worth it?

This is a question you have to answer for yourself. It depends on your income and your health needs.

The extras don’t seem worth it to me. A basic dental check-up and eye exam don’t cost that much to begin with. The insurance option around optometry that I saw only covers frames up to $150 (the ugly ones). When my partner needed glasses last year, he chose to buy attractive designer frames online. Medicare paid for the exam and he just paid for the lenses.

This goes to the heart of the problem around these “elective” services: it’s cheaper online or outside of Australia. This is why so many Aussies travel to Asia to get their major dental work done.

Another problem typical of insurance is that you never know when you’ll need something until you need it. Let’s say you have basic dental and, like a lot of people, you missed your annual check up. The next thing you know, you have a tooth ache and you learn that you need a root canal and crown. Basic dental doesn’t cover that. You can then purchase more coverage, but there’s a 12-month waiting period for extractions. Who can put up with dental pain for that long?

One alternative is to go for full coverage, but can you can afford it? Do you know you’ll have a job and a steady income month after month? And if you never use it, will that feel like wasted money?

Ambulance cover is worth it. Ambulance treatment and transport can be expensive, especially rural or air transport. For a small annual fee, you can join Ambulance Victoria and be covered anywhere in Australia.

What did you do?

I asked my Aussie friends who offered a wide variety of opinions. I’ve done my own research and had multiple discussions about it with my partner. If I had a consistent, higher income, I would get private health insurance for the both of us. Although my partner and I don’t really need it right now, we would take advantage of it as we aged, and taking it now would avoid a higher LHC loading. For the time being, paying for private health insurance doesn’t make sense for us. However, we did purchase ambulance service.

More resources

Explainer: why do Australians have private health insurance? – This is a good article at The Conversation that explores why Australians opt for private health insurance (and why they don’t).

PrivateHealth.gov.au – Managed by the office of the Private Health Insurance Ombudsman, this website provides a wealth of information.

iSelect – This is an insurance broker that offers an excellent comparison and advisory service. After browsing the website, I called them and a very patient representative answered all my questions.

I’m not an expert. Please consider this a friendly attempt to help. Be sure to seek professional advice before you sign the dotted line.